Insurance Agents in Mesa, AZ: Find Trusted Coverage for Your Home and Life

You need insurance in Mesa, AZ, to protect your home, car, or business. But finding reliable insurance agents in Mesa, AZ, feels overwhelming. The Sonoran Desert’s unique risks, like flash floods or wildfires, make choosing the right coverage urgent. At Insure Me Now Agency, we connect you with trusted carriers like State Farm to secure your peace of mind. Whether you need homeowners insurance in Mesa, AZ, or affordable car insurance, we simplify the process.

Mesa’s vibrant community, from the Mesa Arts Center to the Arizona Museum of Natural History, deserves protection tailored to its needs. You face real challenges: high home insurance costs, complex policies, or even cancelled home insurance policies. We solve this by offering clear, affordable insurance solutions through our independent insurance brokerage. Let’s dive into how we help you tackle these problems.

Why Finding the Right Insurance Agent in Mesa, AZ, Feels So Hard

You’re frustrated. Shopping for insurance in Mesa, AZ, means sifting through countless insurance companies in Mesa, AZ, with confusing terms. If you pick the wrong policy, a fire or flood could leave you paying thousands out of pocket. For example, Mesa’s 2020 windstorm damaged homes across the city, leaving many underinsured homeowners struggling. Without proper coverage, you risk losing your home, car, or business to unexpected disasters. Even worse, high premiums or cancelled policies can drain your wallet or leave you exposed.

What’s the biggest problem you face?

You want affordable, reliable coverage that fits your life in Mesa—whether it’s for your home near Queen Creek or a small business office. But you don’t have time to compare dozens of insurance carriers or decode fine print. The fear of overpaying or missing key coverage, like flood insurance for Mesa’s monsoon season, keeps you up at night.

How do we solve it?

At Insure Me Now Agency, our insurance professionals act as your trusted insurance advisor. We compare top insurance companies in Mesa, AZ, like Nationwide and American Family, to find you the best rates. We offer tailored solutions, from homeowners insurance in Mesa, AZ, to SR-22 car insurance for high-risk drivers. Our process is simple, transparent, and focused on your needs.

- What this looks like in action: We assess your home or business, considering Mesa’s risks like wildfires or burglaries (over 21,000 reported in Arizona annually). Then, we craft a policy that covers your dwelling, personal property, and liability.

- What’s included: Options like home insurance, condo insurance, renters insurance, auto insurance, and business owners’ policies. We also handle specialty needs like flood insurance or commercial auto insurance for your landscaping business.

- The cost or effort: You get free quotes in minutes. We explain deductibles, limits, and premiums clearly, so you know exactly what you’re paying for.

- Our guarantee: As an independent insurance brokerage, we work for you, not the insurance companies. If you’re not satisfied, we’ll adjust your policy to fit your needs.

- Your decision: Contact us today to get a free quote and secure your peace of mind. Don’t wait for a disaster to strike.

Homeowners Insurance in Mesa, AZ: Protect Your Biggest Asset

Your home in Mesa, near the Heard Museum or a quiet Queen Creek neighborhood, is your sanctuary. But Mesa’s weather—flash floods, wildfires, or windstorms—puts it at risk. Homeowners insurance in Mesa, AZ, shields you from these dangers. We offer policies covering fire, theft, vandalism, and even additional living expenses if you can’t stay home after a covered loss.

- Dwelling coverage: Repairs or rebuilds your home after fire or storm damage.

- Personal liability: Covers injuries or damages if someone gets hurt on your property.

- Flood insurance: Protects against Mesa’s monsoon floods (often not covered by standard policies).

- Condo or renters insurance: Secures your personal items or liability as a renter or condo owner.

- Luxury home insurance: Tailored for high-value homes with unique needs.

Why trust us? Unlike single-carrier agents, our independent brokerage compares trusted carriers like Chubb and State Farm. We ensure you get comprehensive coverage at competitive rates, saving you up to 20% on premiums. Contact us for a free homeowners insurance quote.

Why Do I Need Flood Insurance in Mesa, AZ?

Question: Does homeowners insurance in Mesa cover floods?

Answer: Standard homeowners insurance doesn’t cover flood damage. Mesa’s monsoon season brings heavy rains, and 2021 saw significant flash flooding in Arizona.

Solution: We offer flood insurance through the National Flood Insurance Program (NFIP) or private carriers. This covers your home and belongings against rising waters.

Key takeaway: Add flood insurance to your policy for full protection. It’s often required if you have a mortgage in a flood zone.

Alternative: If flood insurance seems costly, consider raising your deductible to lower premiums or installing flood-resistant barriers.

Car Insurance in Mesa, AZ: Drive with Confidence

Driving in Mesa’s busy streets, from the 512,000 residents commuting to work to weekend trips to the Sonoran Desert, requires solid car insurance. Accidents, wildfires, or uninsured drivers can hit your wallet hard. We provide affordable options, including cheap car insurance, SR-22 for DUI drivers, and full coverage for peace of mind.

- Comprehensive coverage: Protects against wildfires or floods damaging your car.

- Liability coverage: Covers damages or injuries you cause in an accident.

- SR-22 insurance: Meets Arizona’s legal requirements for high-risk drivers.

- Uninsured driver protection: Shields you from Mesa’s rising number of uninsured motorists.

Why choose us? We bundle home and auto insurance to save you 10-15% on premiums. Our auto insurance page details how we keep your rates low while meeting Arizona’s legal standards.

How Can I Get Cheap Car Insurance in Mesa, AZ?

Question: How do I find affordable car insurance in Mesa?

Answer: Mesa’s growing population means more drivers and higher accident risks, pushing up rates. The average car insurance cost in Mesa is $160/month, but you can pay less.

Solution: We compare 40+ carriers to find you the cheapest rates. Options like bundling with home insurance or choosing a higher deductible can cut costs.

Key takeaway: Shop around with an independent agent to save money without losing coverage.

Alternative: Install safety devices like alarms or take a defensive driving course for discounts.

Business Insurance in Mesa, AZ: Safeguard Your Livelihood

Running a small business in Mesa, whether a landscaping company or a property management firm, comes with risks. A lawsuit, fire, or employee injury could shut you down. Our business insurance solutions, like general liability insurance and workers’ compensation, keep you protected.

- General liability: Covers lawsuits from property damage or injuries.

- Workers’ compensation: Pays for employee injuries on the job.

- Commercial auto: Insures your delivery trucks or construction vehicles.

- Cyber liability: Protects against data breaches for your small business office.

Why act now? Mesa’s economy is growing, but so are risks like vandalism or lawsuits. Our business insurance page shows how we tailor policies to your industry, ensuring financial security.

What Insurance Do I Need for My Mesa Small Business?

Question: What types of insurance does my Mesa business need?

Answer: Every business faces unique risks, from customer injuries to equipment damage.

Solution: We assess your business and recommend a business owners’ policy (BOP) that bundles general liability, property, and more. Add workers’ comp or commercial auto as needed.

Key takeaway: A custom BOP saves money and covers your biggest risks.

Alternative: Start with basic liability coverage and add policies as your business grows.

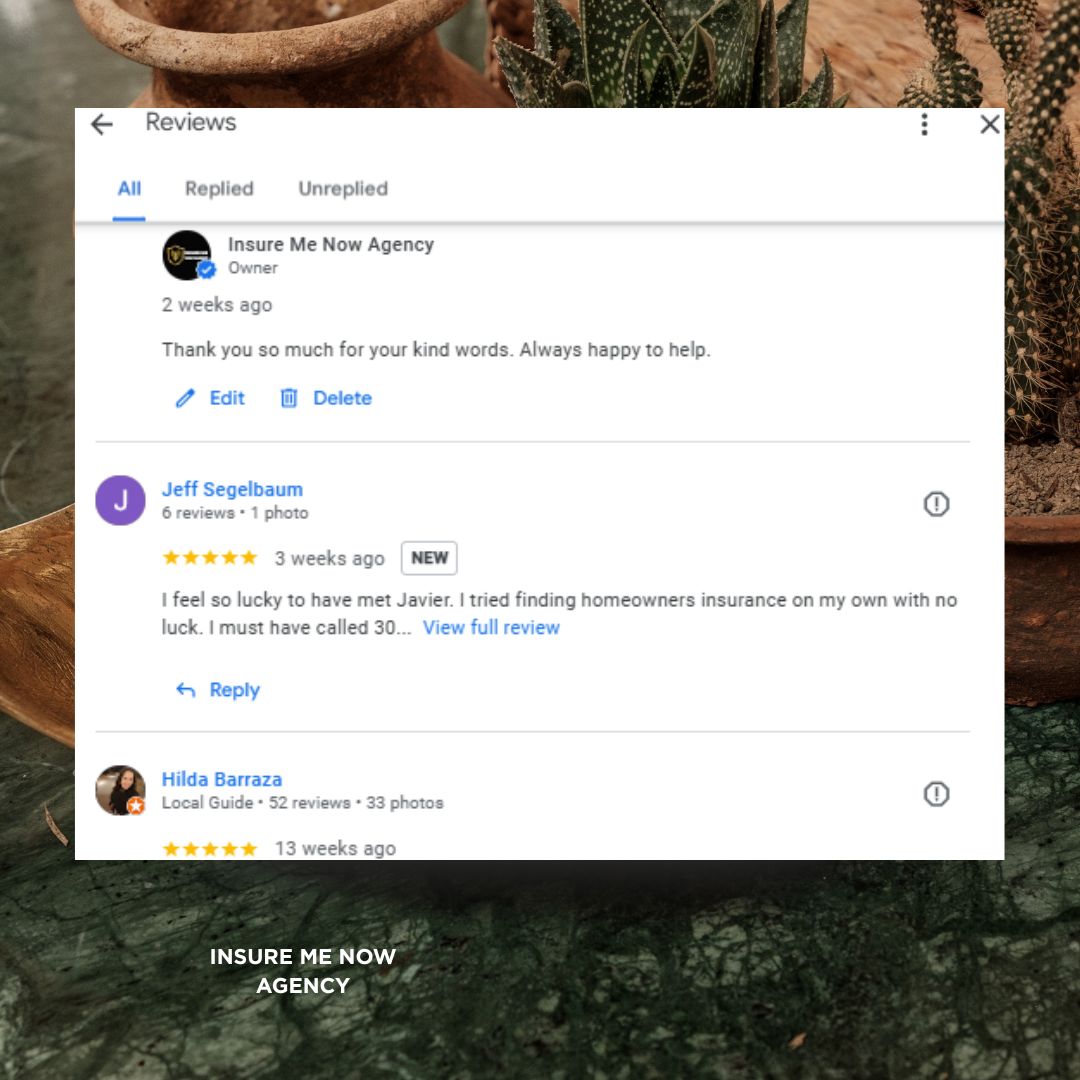

Our Clients Say

FAQ: Your Insurance Questions Answered

Q: How much does homeowners insurance cost in Mesa, AZ?

A: The average cost is $2,025/year for $200,000 dwelling coverage. Rates vary by home value, location, and claims history. Get a free quote from us to find the best price.

Q: Can I get car insurance without a license in Mesa?

A: Yes, we offer policies for drivers with a matricula consular, passport, or no license. Options include basic coverage (cobertura basica) to meet Arizona’s legal requirements.

Q: Does renters insurance cover my belongings in Mesa?

A: Yes, it covers personal property, liability, and additional living expenses. It’s affordable, starting at $10/month. Check our renters insurance page.

Q: What’s the benefit of an independent insurance agent?

A: We shop multiple carriers to find you the best rates and coverage. Unlike captive agents, we prioritize your needs over one company’s.

Why Choose Insure Me Now Agency?

You deserve an insurance advisor who understands Mesa’s risks and your budget. At Insure Me Now Agency, we deliver tailored solutions for homeowners insurance, car insurance, and business insurance in Mesa, AZ. Our team, rooted in Mesa’s community, from Native American heritage events to local festivals, ensures you get coverage that fits your life. Don’t risk financial ruin from a flood, fire, or lawsuit. Contact us now for a free quote and start protecting what matters most.